To begin, we need to define our current system and the factors involved with it. This article will deal with just a few aspects of the system: The age in which you are collecting, the totals payroll costs of the system and what portion of your salary is going to fund the system.

At the age of 62 you are eligible to receive minimum benefits for social security. At this age you can chose to get into the system at a reduced rate, or wait until subsequent years and receive a greater percentage of your graduated salary. Here is the statement included about retirement at age 62 from SSA.GOV:

You can get Social Security retirement benefits as early as age 62, but if you retire before your full retirement age, your benefits will be permanently reduced, based on your age. For example, if you retire at age 62, your benefit would be about 20 percent lower than what it would be if you waited until you reach full retirement age.

Your full retirement age at present is 67 for anyone born after 1960 and 65 for anyone born after 1937 with various changes in age requirements between those years. You can also chose to work until the age of 70 and gain increased benefits. A good representative of this system is also found at SSA.GOV:

Each additional year you work adds another year of earnings to your Social Security record. Higher lifetime earnings may mean higher benefits when you retire.

Also, your benefit will increase automatically by a certain percentage from the time you reach your full retirement age until you start receiving your benefits or until you reach age 70. The percentage varies depending on your year of birth. For example, if you were born in 1943 or later, we will add 8 percent per year to your benefit for each year that you delay signing up for Social Security beyond your full retirement age.

The next factor in this system is how much money you will receive at retirement. For simplicity’s sake, we shall use the SSA.GOV calculator to determine your income considering a person earning $60,000 for at least 10 years. We will not be including the inflation estimate as it gives an inflated number of valuations that do not equate to today’s current value. Retirement values per month are:

Age 62: $1,263.00

Age 67: $1,794.00

Age 70: $2,224.00

If these numbers seem small to you remember that social security was never meant to entirely replace other means of retirement. It was meant as a means of preventing poverty in old age. However, over time it has included several other at-risk populations, but was still not meant as one’s only means of income. (Sharp, 401) In fact, only 18% of Americans use it as such today. (Sharp, 408) It wasn’t meant to enhance your life, only sustain it.

To add an extra factor to this from someone observing the things that happen at retirement age, the above numbers are not as meager as the look. This comes into effect by taking note of the standard 30-year mortgage. Most Americans will own their own home by the age of retirement or before. The mortgage normally consists of about half of your total income. Say, for example, you are making about $4,000 per month (the calculation of $60,000 a year and 20% income tax) you will receive about half of that at retirement age or only slightly less.

The last factor required in order to better understand the current situation is how much social security is costing today. I am going to have to split this up into two different sections. There are topics that cover both the taxed end of things, and then there is the total of all Social security revenues combined for payout to our seniors and other at-risk populations.

As the current tax system for social security stands, we will pay 1.45% of our pay to Medicare and 6.2% towards Social Security. The business end of this is matching that of your individual contribution. It equates to 15.3% of your payroll. Once we reach $80,400 in earnings per year we no longer have the payroll tax on either side, but the Medicare tax of 1.45% remains on both sides, employer and employee. This makes your additional taxes total 2.9% of your remaining pay over $80,400. This will actually change the $4,000 per month at a base of $60,000 per year after taxes to $3,694 monthly. This means $306 of your hard earned money goes towards Social Security and Medicare every month.

The last portion of things that needs to be understood is the amount of money required to fund social security and where it is officially headed. According to the Congressional Budget Office (CBO):

The Congressional Budget Office (CBO) projects that spending for Social Security, adjusted for inflation, will rise from $483 billion in 2003 to $2.5 trillion in 2075. Those estimates are based on CBO's 10-year baseline budget outlook and the "intermediate" long-range assumptions of the trustees of the Social Security system.

From some of the reports I have been hearing about Social Security, I was under the assumption that we were paying a lot more into the system. To quote Professor Kim, Strayer University online:

Out of about $2.2 trillion government spending each year, 32% is spent on Social Security and Medicare…

If this were true, 32% of 2.2 trillion dollars equates to $704 billion instead of the aforementioned $483 billion. There are several other examples of misrepresented numbers and it appears that you can get a different answer to this question simply by asking another official who has checked his or her own numbers. It has become an area of extreme confusion. The best representation of accuracy that can be mustered is the Summary of the 2004 Annual Reports from SSA:

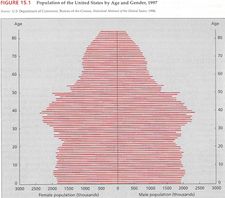

Now we need to compare this rate of inflated Social Security benefits to the age demographics of people through several generations. This is where we can cross-reference and determine at what age Social Security will run out

By looking at the chart and calculating how much will be owed, it appears the first major decline in this system will rear its ugly head in 5-50 years. This is when those aged 50 will be 62, the minimum required age or 67, the fully vested age of Social security. If you’ll notice, 10 years after that, we will be in a much worse predicament, when those that are in their 40s are of retirement age.

Now that we have defined the problem we need to determine what can be done to fix it. How can we save Social security so that we don’t bankrupt America? As the government sees it there are effectively three methods of accomplishing this. They are raising the tax rate for those paying in, increasing the age of retirement or creating personal retirement accounts.

Personal savings accounts (PSA), in reality, do nothing to directly change the Social Security deficit. What they do is put a portion of your funds into a more direct account that you can have some personal control over. It does a lot to increase your personal retirement wealth, but does not fund the system. It really doesn’t do much against the system either. Remember that every dollar taken out of the system is a dollar that doesn’t need to be repaid to that particular retiree. Since the overall burden would be smaller the general fund would be more capable of supporting the smaller system.

According to initial ideals, the startup of this program would be one third of your social security benefits being put into your PSA. Taking the 2004 OASI from earlier, if left in a vacuum, we are left with 372 billion in the system. We are not in a vacuum though and will be subject to several external forces that may equate with a greater or smaller reduction in overall OASI.

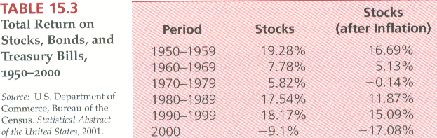

As a sub-system within this program the extra money that is to be gained over the current system is at a minimum 9% more than Social Security's COLA adjustments per year. This is according to the total return on stocks after inflation for the past 50 years (From 1950-1999) as compared with COLA, or straight inflation adjustment. (Sharp, 414)

The first thing that we need to do to this 9.73% is to remove the 1% handling fee accorded to the model we are using for PSA, The Thrift Savings Plan. (TSP.GOV) This leaves us with an average of 8.73% gain on the current Social Security plan annually. The true rate of your return can vary by choosing either the G, F, C, S or I varieties of mutual funds or even lose money in the event of something completely catastrophic. (The two years after 9/11 were two such years.)

Some of the additional 8.73% on average could even go towards funding the aging Social Security structure. I believe 2% would bring in approximately four billion in free revenues. It would still leave an average annual gain of 6.73% over COLA for the individual per year.

Another potential hazard is something called the ripple effect. This is where you take a large sum of money and pump it into the stock market, artificially boosting stock prices. In the stock market’s need to retain stability the stock will flux downward to adjust for the real worth of a stock. It will retain several smaller ripples to the initial drop of 202 billion into the market, and eventually level off slightly higher than if no influx of cash were ever made.

To put this in perspective, Toys ‘R’ Us recently agreed to they buyout figure of 6.6 billion dollars. (MSN Money) The stock for this company instantly increased 8%. For the same 8% push from the 202 billion dropped into PSA’s you would only need to invest in 31 total companies. Each of the five TSP funds has several times more than this. (The C fund matches the S&P 500, or Standard and Poor’s top 500 performing stocks.)

Increasing the tax burden on Social Security has had success in preventing the total melt down of the system. It has also had some adverse effects on GDP. This is a basic principle of economics theorized under “Tax Incidence and Efficiency Loss. (McConnell, 652) The more you tax people, the less money there is to be taxed. This system contains an equilibrium point that we are currently close to already. Unless you plan on getting creative with how you tax people, like raising the payroll tax cap from 80,400 to something like 100,000, then you will have potentially created an economic recession, or at a minimum, a decrease in economic and tax revenue progression. The biggest question you would need to ask is if we are currently at, above or below our tax versus income equilibrium.

The third option on the table is that of changing the age of retirement. Currently the ages of retirement are 62 for your minimum available payout, 67 for your full payout (if you were born after 1960), and up to 70 for an extra payout. Theoretically, you could raise each of these ages by one or two and reap an overall tax savings of hundreds of billions of dollars. It would make sense too. People are living longer than ever before. The overall benefits per individual would be reduced to a more manageable level and you would be matching your system to a longer living society. Unfortunately, this would only delay the inevitable by one or two years. Politicians, being who they are, would more than likely spend the money in other programs and in turn have nothing left over for our seniors. They did it before in the 1990s when there was a surplus in the general fund that could have gone to insure Social security but chose to retire some of the national debt held by the public. (Sharp, 413)

So there you have it, three distinctly different alternatives to the problem of social security. Each system holds its benefits and drawbacks for implementation. The wrangling you hear on either side of the political fence is greatly exaggerated. You hear about how Bush plans to destroy the system through private accounts. (AARP) You hear how no one could feasibly survive on Social Security as it stands today. (CATO Institute) It appears the only thing they can agree on, now, is that there is a problem that needs to be addressed. That wasn’t even the case a month ago. You heard several voices of Democrat origins claim there was absolutely no problem. This is false. There is a very real problem that needs to be addressed immediately; not tomorrow or next year, today. The only way to destroy Social Security is to do nothing about it. We need to fix it.

BIBLIOGRAPHY

Sharp, Ansel M., Register, Charles A., and Grimes, Paul W., Economics of Social Issues. 16th ed. New York: McGraw-Hill. 2004.

McConnel, Campbell R., Brue, Stanley L., Economics. 14th ed. Irwin/McGraw-Hill. 1999

Social Security Administration (SSA): Retirement age and benefits quotes:

http://www.ssa.gov/pubs/10035.html

Social Security Administration (SSA): SSA Retirement Calculator

http://www.ssa.gov/retire2/AnypiaApplet.html

Congressional Budget Office (CBO): Current costs of Social Security: http://cbo.gov/showdoc.cfm?index=4380&sequence=0

Comments from week 10 Strayer Online ECO405 Professor Kim, Hong-Jin: http://www.strayeronline.net/ec/crs/default.learn?CourseID=2134217&CPURL=

www.strayeronline.net&Survey=1&47=1016618&ClientNodeID=421648&coursenav=0

Thrift Savings Plan: http://www.tsp.gov/

MSN Money: Toys R Us buyout

http://money.cnn.com/2005/03/17/news/fortune500/toysrus/

Crossposted at: Blogger News Network

6 comments:

Hello !.

You re, I guess , perhaps curious to know how one can make real money .

There is no initial capital needed You may commense earning with as small sum of money as 20-100 dollars.

AimTrust is what you thought of all the time

AimTrust represents an offshore structure with advanced asset management technologies in production and delivery of pipes for oil and gas.

It is based in Panama with structures around the world.

Do you want to become a happy investor?

That`s your chance That`s what you wish in the long run!

I`m happy and lucky, I began to take up income with the help of this company,

and I invite you to do the same. It`s all about how to select a proper partner utilizes your savings in a right way - that`s AimTrust!.

I earn US$2,000 per day, and what I started with was a funny sum of 500 bucks!

It`s easy to join , just click this link http://xypucetoba.kogaryu.com/ejufate.html

and lucky you`re! Let`s take our chance together to feel the smell of real money

Good day !.

You re, I guess , probably curious to know how one can manage to receive high yields .

There is no initial capital needed You may commense earning with as small sum of money as 20-100 dollars.

AimTrust is what you haven`t ever dreamt of such a chance to become rich

AimTrust incorporates an offshore structure with advanced asset management technologies in production and delivery of pipes for oil and gas.

Its head office is in Panama with offices around the world.

Do you want to become a happy investor?

That`s your chance That`s what you really need!

I`m happy and lucky, I began to get income with the help of this company,

and I invite you to do the same. It`s all about how to select a correct partner who uses your money in a right way - that`s the AimTrust!.

I make 2G daily, and my first investment was 500 dollars only!

It`s easy to start , just click this link http://jykywyfu.freecities.com/ahylyt.html

and go! Let`s take our chance together to feel the smell of real money

Good day !.

might , probably curious to know how one can reach 2000 per day of income .

There is no need to invest much at first. You may begin earning with as small sum of money as 20-100 dollars.

AimTrust is what you thought of all the time

AimTrust represents an offshore structure with advanced asset management technologies in production and delivery of pipes for oil and gas.

It is based in Panama with structures everywhere: In USA, Canada, Cyprus.

Do you want to become really rich in short time?

That`s your chance That`s what you really need!

I feel good, I began to take up income with the help of this company,

and I invite you to do the same. It`s all about how to select a correct partner who uses your funds in a right way - that`s the AimTrust!.

I earn US$2,000 per day, and my first investment was 500 dollars only!

It`s easy to start , just click this link http://kaliwoto.o-f.com/domakaz.html

and go! Let`s take our chance together to become rich

Hi!

You may probably be very curious to know how one can manage to receive high yields on investments.

There is no need to invest much at first.

You may begin to get income with a money that usually is spent

for daily food, that's 20-100 dollars.

I have been participating in one company's work for several years,

and I'm ready to share my secrets at my blog.

Please visit blog and send me private message to get the info.

P.S. I make 1000-2000 per day now.

[url=http://theblogmoney.com] Online investment blog[/url]

Hello!

You may probably be very interested to know how one can make real money on investments.

There is no need to invest much at first.

You may commense earning with a money that usually goes

for daily food, that's 20-100 dollars.

I have been participating in one company's work for several years,

and I'm ready to let you know my secrets at my blog.

Please visit blog and send me private message to get the info.

P.S. I earn 1000-2000 per day now.

[url=http://theinvestblog.com] Online investment blog[/url]

Glad to greet you, ladies and gentlemen!

We are not acquainted yet? It’s easy to fix,

friends call me James F. Collins.

Generally I’m a venturesome gambler. for a long time I’m keen on online-casino and poker.

Not long time ago I started my own blog, where I describe my virtual adventures.

Probably, it will be interesting for you to find out how to win not loose.

Please visit my web page . http://allbestcasino.com I’ll be interested on your opinion..

Post a Comment